Table of Contents

AI in asset management is transforming the way financial institutions and investors manage portfolios and optimize strategies. As the industry evolves, AI-driven tools are enabling more accurate predictions, enhanced decision-making, and streamlined operations. In 2024, leveraging AI can provide a competitive edge by offering deeper insights, reducing risks, and increasing overall efficiency.

This article explores the key benefits of AI in asset management, highlighting how these advancements can drive success in the coming year.

How does AI in asset management work?

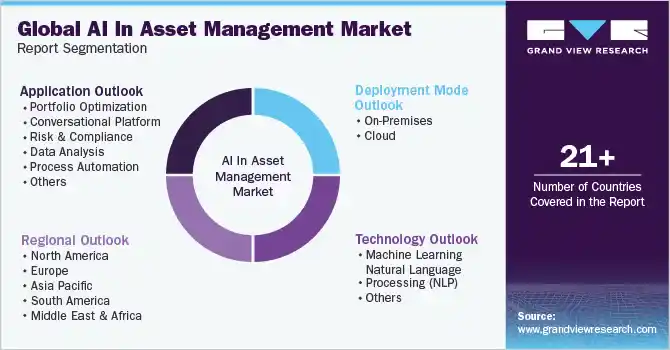

Data Collection: AI in asset management gathers extensive data from financial markets, economic reports, and other relevant sources, both structured and unstructured.

Data Processing: The AI system processes and analyzes this data using techniques like Natural Language Processing (NLP) to extract actionable insights.

Pattern Recognition: AI identifies patterns and correlations within the data, helping to forecast asset performance and market trends.

Predictive Modeling: AI builds predictive models based on historical data and current market conditions to guide investment decisions.

Portfolio Management: AI automates tasks like asset allocation, rebalancing, and risk management, optimizing portfolio performance in real-time.

Risk Assessment: AI evaluates various risks, including market volatility and credit risks, to predict and mitigate potential threats to the portfolio.

Automation of Tasks: Routine tasks such as trade execution and compliance monitoring are automated by AI, increasing efficiency and accuracy.

Continuous Learning: AI systems continuously learn from new data, adapting their strategies to stay effective in changing market conditions.

Personalization: AI analyzes individual investor preferences to offer personalized investment advice and tailored portfolio management.

Decision Support: AI provides data-driven insights and real-time analysis, supporting more informed and strategic decision-making by asset managers.

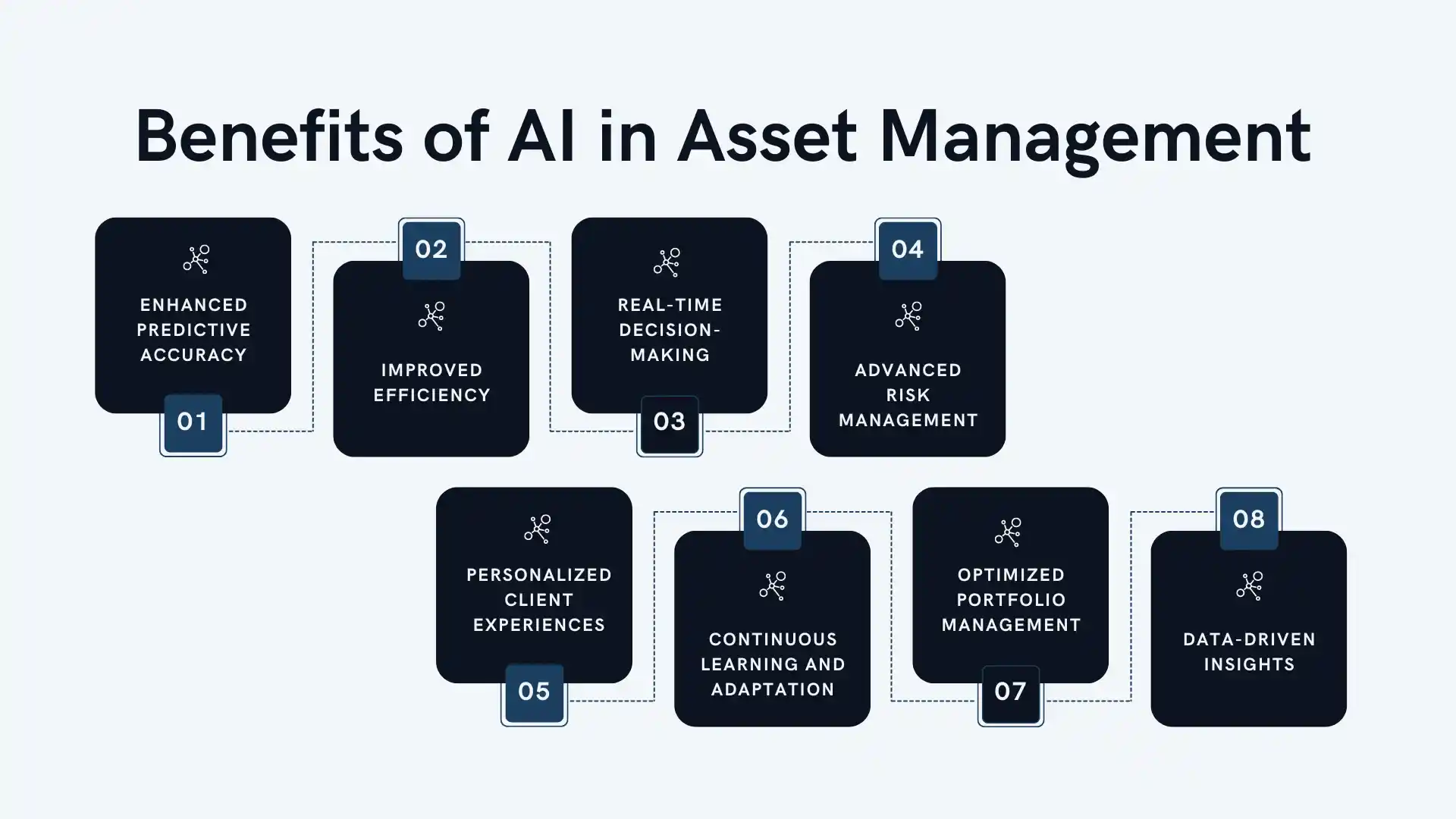

Key Benefits of AI in Asset Management

Enhanced Predictive Accuracy

AI in asset management improves predictive accuracy by analyzing large datasets and identifying patterns. This allows asset managers to anticipate market trends, make informed investment decisions, and optimize portfolio performance, leading to more reliable and strategic outcomes.

Improved Efficiency

AI automates routine tasks like data processing, trade execution, and compliance checks. This reduces operational costs, minimizes errors, and frees up time for asset managers to focus on higher-value activities, enhancing overall efficiency.

Real-Time Decision-Making

AI enables real-time analysis and decision-making by processing vast amounts of data instantaneously. Asset managers can quickly respond to market changes, adjusting strategies on the fly to capitalize on opportunities and mitigate risks.

Advanced Risk Management

AI provides sophisticated risk assessment tools that analyze various factors, such as market volatility and economic indicators. This helps asset managers to better predict and manage potential risks, ensuring more resilient and stable investment strategies.

Personalized Client Experiences

AI enhances client service by analyzing individual investment preferences and behaviors. It allows asset managers to offer tailored advice and customized portfolio solutions, improving client satisfaction and fostering stronger relationships.

Continuous Learning and Adaptation

AI systems continuously learn from new data and adapt to evolving market conditions. This ensures that asset management strategies remain up-to-date and effective, providing a competitive edge in a dynamic financial landscape.

Optimized Portfolio Management

AI automates portfolio management tasks such as asset allocation and rebalancing. This ensures portfolios consistently align with market conditions and investment goals, leading to better returns and reduced risks.

Data-driven insights

AI provides deep, data-driven insights that guide strategic decision-making. By analyzing complex data sets, AI helps asset managers uncover hidden opportunities and make more informed decisions, contributing to better investment outcomes.

Embrace AI for Asset Management

AI in asset management stands as a transformative force in 2024, offering unparalleled advantages to businesses. By leveraging AI, organizations can optimize asset performance, reduce risks, and enhance decision-making processes. These benefits not only streamline operations but also position companies for long-term success in a competitive market.

As the technology continues to evolve, those who embrace AI-driven strategies will find themselves at the forefront of innovation, maximizing returns and securing a robust future. The potential of AI in asset management is vast, making it an essential tool for any forward-thinking organization aiming to achieve sustainable growth and efficiency.

FAQs

What is AI in asset management?

- AI in asset management refers to the use of artificial intelligence technologies, such as machine learning and data analytics, to improve investment strategies, optimize portfolio management, and enhance decision-making processes.

Q: How does AI gather and process data in asset management?

- AI collects vast amounts of data from various sources, including market trends, financial reports, and economic indicators. It then processes this data using advanced algorithms to extract actionable insights.

Q: What role does AI play in decision-making for asset management?

- AI helps asset managers by providing real-time analysis, predictive models, and data-driven insights, enabling more informed and strategic investment decisions.